|

|

| |

|

|

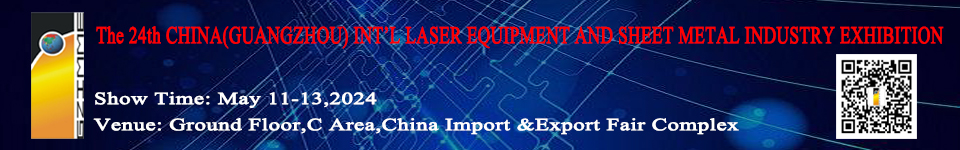

Nippon Steel & Sumitomo Metal chief wary of new wave of protectionism- The 18th China£¨Guangzhou£©Int¡¯l Sheet metal machinery,Forging, Stamping and Setting Equipment Exhibition

12/1/2016 sheet metal expo |

--------------------------------------------------------------------------------------------------------------- |

|

Nippon Steel & Sumitomo Metal President Kosei Shindo , president of Nippon Steel & Sumitomo Metal, weighed in on these matters in a recent interview with Nikkei

Q: Steel product prices are on the rise, especially in Asia. What is driving the uptrend?

A: Steel product prices in Asia hit bottom in December last year. The price of benchmark hot-rolled coil is now hovering around $450 per ton in Southeast Asia, up from slightly above $280 at the end of last year. Given rising materials prices, the prices of steel products are likely to head higher still.

Domestic demand for steel products grew from 14.93 million tons in the April-June quarter to 15.62 million tons in the July-September period. It is projected to increase further to 15.73 million tons in the October-December quarter. In the construction sector, demand in both the housing and nonhousing segments started picking up this summer. Auto production has already recovered from the negative effects of the Kumamoto earthquakes [in April]. Our plants that manufacture automotive steel sheet are currently running at full capacity.

Demand for steel is generally firm and domestic inventories of thin steel plate have fallen to appropriate levels.

Q: Are you worried about a resurgence of protectionism in the U.S. under President-elect Donald Trump?

A: A total of 209 anti-dumping investigations involving steel imports are underway worldwide, and 32 of them involve Japanese products. The number of cases in which safeguard measures are taken [to protect domestic industries from the effects of sudden increases in imports] has also increased. A new wave of protectionism in the U.S. could lead to greater Japanese imports of products made in countries that have been pushed out of the U.S. market, like South Korea.

If the Trans-Pacific Partnership trade pact fails to come into effect, or NAFTA (North American Free Trade Agreement) is reviewed, the auto and other steel-consuming industries will be affected seriously. Such moves [against free trade] are based on an outdated view that imports and immigrants cost domestic workers their jobs.

Countries should persuade the Trump administration to discard this old-fashioned way of thinking and promote free trade to create jobs at home.

Nippon Steel chief wary of ''new wave of protectionism''

Q: Have concerns about the Chinese economy eased?

A: China produced 68.51 million tons of crude steel in October, a 4% increase from a year earlier. China''s crude steel output in the first 10 months of this year was also larger than the same period last year. Still, the country''s domestic crude steel inventory has not increased. Its crude steel exports declined to 7.7 million tons in October from over 10 million in July.

It seems that China''s policy measures to shore up the economy, such as public investment and tax breaks for car purchases, are proving effective. But China''s structural problems, including excess production capacity, remain unresolved.

Q: Will the country''s steel industry be able to cut its excess capacity?

A: The Chinese government has demonstrated a strong commitment to its goal of reducing the country''s steel production capacity by 150 million tons in five years. A merger between two leading state-owned steelmakers, Baosteel Group and Wuhan Iron and Steel (Group), has been announced. It will, of course, take time to eliminate excess capacity because doing so requires massive employment shifts. Europe, the U.S. and Japan were also forced to push through capacity reductions of about 20% after their industries reached maturity.

China will have to carry out capacity consolidation of a similar scale, meaning it will have to go beyond its current streamlining goal.

Q: What do rising materials costs mean for the steel industry?

A: This is a sticky situation for steelmakers. The spot price of coking coal has jumped to $300 per ton from less than $100 at the beginning of the year. The uptick was triggered by the Chinese government''s move to slash coal production to wipe out the excess. Iron ore prices are following the upward path of coal prices. A sharp decline of the yen is also pushing up materials costs .

-

The 18th China£¨Guangzhou£©Int¡¯l

Sheet metal machinery,Forging, Stamping and Setting Equipment Exhibition

|

|

|

|

|